Members of crypto think tank GFX Labs’ governance division are ringing the alarm bells that a prominent large investor may be attempting to leverage large sums of capital to manipulate on-chain governance for a decentralized finance (DeFi) protocol.

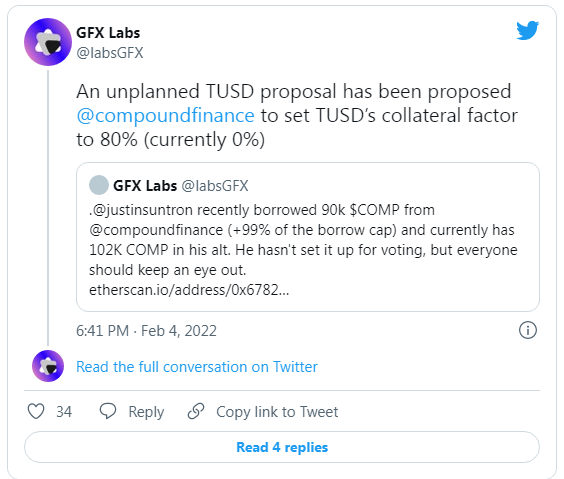

In a tweet on Friday, GFX’s Twitter handle called attention to a massive loan of Compound’s governance token, COMP, taken out by billionaire Justin Sun.

On-chain governance of DeFi protocols is often token-weighted, and while one GFX representative personally characterized the loan as a “governance attack,” there is nothing explicitly prohibiting users from taking out loans to vote on proposals they back.

Sun – founder of the Tron platform and now Grenada’s ambassador and permanent representative to the World Trade Organization – is an active DeFi user, and his primary address worth over $1 billion is widely tracked among on-chain sleuths. Sun didn't respond to a request for comment by press time.

What happened

On-chain data shows that on Thursday, Sun’s wallet borrowed 99,000 COMP tokens worth over $13 million and later sent 102,000 tokens to Binance, the world's largest crypto exchange.

On Friday, an address that received $9 million worth of COMP tokens from Binance proposed adding TUSD as a collateral asset on Compound, which would allow Compound users to take out loans against their TUSD holdings.

While it is impossible to definitively verify that the proposal address belongs to Sun, according to pseudonymous GFX Labs contributor PaperImperium, the pattern is reminiscent of a similar vote that took place in stablecoin issuer MakerDAO’s governance in January.

“Justin borrowed a large amount of MKR from Aave,” PaperImperium said. “Presumably this was to vote on a poll to create a TUSD-DAI Peg Stability Module. After it was noticed, he returned the MKR before voting.”

Creating a stability module would allow users to swap TUSD for MakerDAO’s DAI stablecoin at a fixed rate. In the poll, the community voted the proposal down before it could move to formal voting.

A TUSD representative wrote in Maker’s governance forums after the poll concluded that they were unaware of Sun’s actions, and that “we wouldn’t risk working with Justin Sun, or any whales, to manipulate votes.”

Sun is listed as an Asia markets adviser on TUSD’s website, and a blog post from 2020 notes that “ownership of TUSD will be moving over to an Asia-based consortium that will be working with TRON to develop TUSD on Ethereum, TRON and other blockchain networks.”

All about utility

Other stablecoins have attempted similar gambits in recent weeks as the need for utility pushes platforms to leverage “bribe” protocols.

There are dozens of decentralized stablecoins now on the market, which is largely dominated by centralized alternatives like Tether and USDC. Additionally, generating interest and usage is an uphill battle if lending protocols, and other DeFi platforms don’t accept deposits.

A growing number of services now cater to helping user in integrations, such as Bribe, which allows protocols to bribe Aave token holders to vote certain ways on proposals.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!