India, with a population of 1.4 billion, is becoming the fastest-growing cryptocurrency market, and more than 20 million cryptocurrency holders are waiting for the implementation of relevant regulatory policies in the country.

Regulatory uncertainty is increasing. The "Encrypted Currency and Official Digital Currency Regulation Act of 2021" originally scheduled to be submitted at the winter meeting of the Indian Parliament in December has been delayed. The bill proposes to ban all private cryptocurrencies in India. Local media quoted people familiar with the matter as saying that the government is still finalizing the details of the legislation and the cabinet has not yet approved the proposed legislation.

The delay in policy formulation has brought a window period for the development of India’s crypto industry. Whether it is the market demand for crypto assets, the scale or the attractiveness of the crypto industry to talents, India has entered a period of rapid growth. According to reports, starting from January 2018 and December 2020, the trading volume from Indian cryptocurrency exchanges accounted for 5% of the total global trading volume.

In the eyes of observers, after China's total ban on cryptocurrency, India's crypto industry is likely to become the center of the crypto industry in Asia if it can obtain regulatory norms and guidance.

India postpones the development of cryptocurrency policy

India’s 2021 Encrypted Currency and Official Digital Currency Regulatory Act is likely to be postponed. According to Indian media reports, the government is considering amending the proposed bill. People familiar with the matter revealed to the media that the government has not finalized the legislative details.

This bill has been enacted for more than a year and was originally scheduled to be submitted at the winter meeting of the Indian Parliament starting on November 29. It aims to ban all private cryptocurrencies in India in order to promote the issuance of the Reserve Bank of India (RBI, the Central Bank of India). Official digital currency. The winter parliament meeting that ended on December 23 has not yet discussed the bill, and the cabinet has yet to approve the proposed legislation.

The schedule for the last week of parliamentary meetings has removed the cryptocurrency bill from the list of businesses on its website. However, during the adjournment of the parliament, the government can still introduce legislation through decrees. The delay is reported to be due to the Indian government’s belief that “the ever-changing global cryptocurrency regulation requires more extensive negotiations”.

The delay of the bill also brings a window period for the growth of India's crypto industry and cryptocurrency market.

India, with a population of nearly 1.4 billion, is one of the fastest-growing cryptocurrency markets in the world. Statistics show that India has more than 20 million cryptocurrency account holders and has surpassed the stock market, with a cumulative total of 6 billion rupees (equivalent to 79.14 million U.S. dollars) invested in cryptocurrency. Among the 20 million cryptocurrency holders, the average age of investors is around 25, and most investors are between 25-34 years old.

A report by Crebaco and Khaitan & Co shows that cryptocurrencies, especially Bitcoin and Ethereum, are becoming more and more popular in India. The report believes that India's crypto industry is worth 15 billion U.S. dollars. Starting from January 2018 and December 2020, the trading volume of cryptocurrency exchanges in India accounted for 5% of the total global trading volume.

In the past 10 years, India's interest in cryptocurrencies has continued to rise, and catering to demand has spawned a number of crypto asset exchanges such as CoinDCX or WazirX. Recently, CoinDCX was valued at USD 1.1 billion after financing.

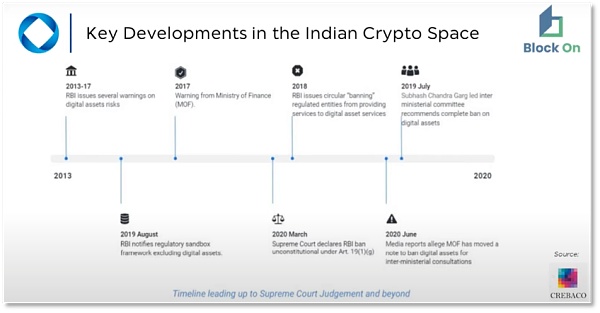

India's regulatory changes for crypto assets

The explosive growth of the market and the emergence of related companies have long worried the regulators. The Central Bank of India has been expressing that cryptocurrency poses a threat to financial stability and the country's macro economy.

Although the government seems to prefer regulation over bans, the Reserve Bank of India (RBI) has not changed its position. According to the “Economic Times” report, RBI reiterated in its detailed introduction to its Central Committee on December 17 that “a comprehensive ban is necessary.” Although RBI did not disclose the details of the presentation, it stated that it discussed “the central bank digital currency CBDC and private All aspects of cryptocurrency".

RBI cited the Reserve Bank of India’s foreign exchange management and regulatory challenges for offshore virtual assets as a reason for seeking a comprehensive ban. This means that the anonymity of crypto asset transactions is a very worrying issue for RBI.

Experts observing the Indian cryptocurrency industry said that as of now, investing in cryptocurrency in India has huge risks unless the government has a clear position on this issue. However, in the future, once regulations are introduced and cryptocurrencies become legalized through appropriate guidance, transactions will become more free for investors, especially young people.

Internet people flood into India's encryption industry

India is one of the fastest growing cryptocurrency markets in the world. A report by the blockchain data platform Chainanalysis shows that from January to June this year, the country's cryptocurrency market has grown by 641% in six months. In the past few months, Indian cryptocurrency exchanges CoinSwitch Kuber and CoinDCX have become unicorns.

Take CoinSwitch Kuber as an example. It is India's leading cryptocurrency exchange. In the past year and a half, its employees have increased from 25 to more than 380. Practitioners in the Internet industry in India are entering the company, including former WhatsApp executive Ashish Chandra (general counsel), Paytm former executive Krishna Hegde (senior vice president of the new plan), Flipkart former executive Jayram Krishnan (product vice president), etc. Executives of Internet companies.

In an interview with The Economic Times, the headhunting company reported that 25 to 30 exchanges operating in India have witnessed the demand for talents in the technical, compliance, legal, risk management, marketing, and sales functions of the crypto industry. With recent changes in India's regulatory policies on the encryption industry, the demand for talents has also been moving in the direction of "managing projects, introducing stricter regulations and more government supervision."

Managers and headhunters of cryptocurrency exchanges said that there are two attitudes in the recruitment process-some talents who are interested in the crypto industry are still skeptical about the industry due to regulatory uncertainties; others are clear. I want to join a cryptocurrency company because they believe this is a track that can make money quickly.

"Although the scale of talents in India's cryptocurrency and blockchain is growing, it is still scarce. This is why we have to provide technicians with high salaries ranging from 150,000 to 700,000 rupees (US$1977 to US$9,226) per month. One,” Praveenkumar Vijayakumar, chairman of Belfrics Global, a Malaysian-based cryptocurrency trading platform, said in an interview, “As exchange operations and enterprises adopt blockchains, the demand for blockchain talents will become even greater. Competitive"

Industry trackers say that in most cases, the average salary provided by the exchange is about 200,000 rupees (US$2,636) per month for technicians with 2 to 4 years of experience.

India's crypto asset market and the development of the crypto industry

In India, the digital skills market is already very strong. Both traditional companies and emerging blockchain companies are hiring technical experts at record levels and the highest salaries in history. According to media reports, the salary of professionals with encryption and Web3 skills is 10-30% higher than that of professionals with the same working years. Consulting firm Transsearch said, “India will become the world’s largest cryptocurrency market, and this industry will be hot for a long time.

Under such a development situation, Himanshu Sharma, who is engaged in the consulting industry, wrote an article that India needs to regulate cryptocurrencies, but does not need to take the road of total prohibition in China. It can learn from global markets such as the United Kingdom and Singapore. In these markets, cryptocurrencies It is also not legal tender, but it is regarded as property that needs to comply with the requirements of financial regulators.

In the eyes of observers, if India's encryption industry can obtain regulatory norms and guidance, it is likely to replace China as the market center of the encryption industry in Asia.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!