Summary

Bitcoin mining stocks have been caught up in the extreme market volatility but are getting a new boost of momentum with a new rally in crypto.

Miners ramping up production this year maintain a positive outlook with a significant growth opportunity.

We highlight our top pick in the sector, which benefits from scale and appears undervalued relative to peers.

Looking for a portfolio of ideas like this one? Members of Conviction Dossier get exclusive access to our model portfolio.

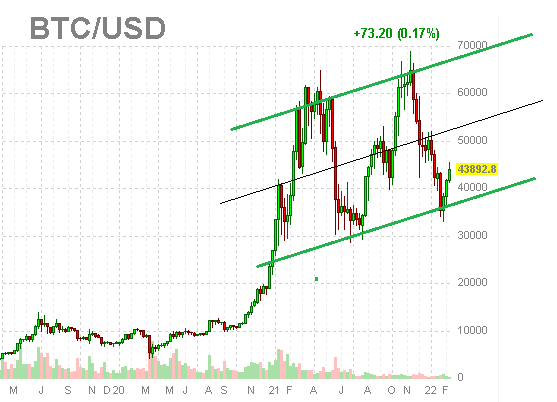

It's been a challenging start to the year for crypto with Bitcoin (BTC-USD) facing a sharp correction from its all-time of $69k in November. We sense that cryptocurrencies as an asset class got caught up in the broader market volatility particularly among more speculative segments of tech forcing a reset of valuations. Still, we highlight that Bitcoin has quietly rallied by more than 33% from its low in January to a current level of $44k helping to lift the sector with a new boost of momentum. The setup here is interesting for crypto mining stocks that have faced even deeper selloffs but are well-positioned to benefit from upside in Bitcoin pricing going forward. We discuss the action in the group and highlight our top pick.

The Attraction of Bitcoin Mining Stocks

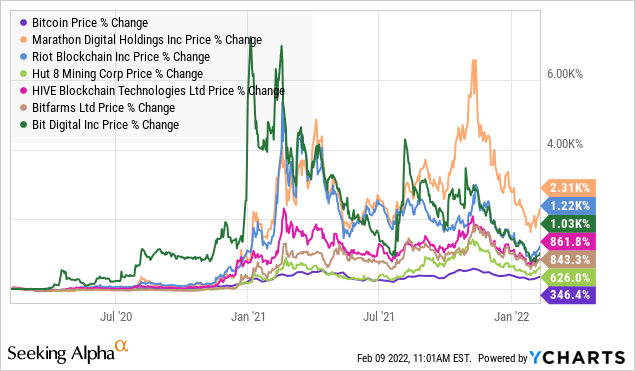

Bitcoin mining stocks with a long enough trading history have been able to outperform Bitcoin. While BTC is up by about 346% from its level in February 2020, industry pioneers that were early in the game like Marathon Digital Holdings Inc (MARA) with a +2,300% gain, Riot Blockchain Inc (RIOT) up 1,220%, along with Hut 8 Mining Corp (HUT), Hive Blockchain Technologies Ltd (HIVE), Bitfarms Ltd (BITF), and Bit Digital Inc (BTBT) have all been "multi-baggers" over the period. The attraction of the business model is the ability to effectively mint an appreciating asset while benefiting from favorable production level economics.

Data by YCharts

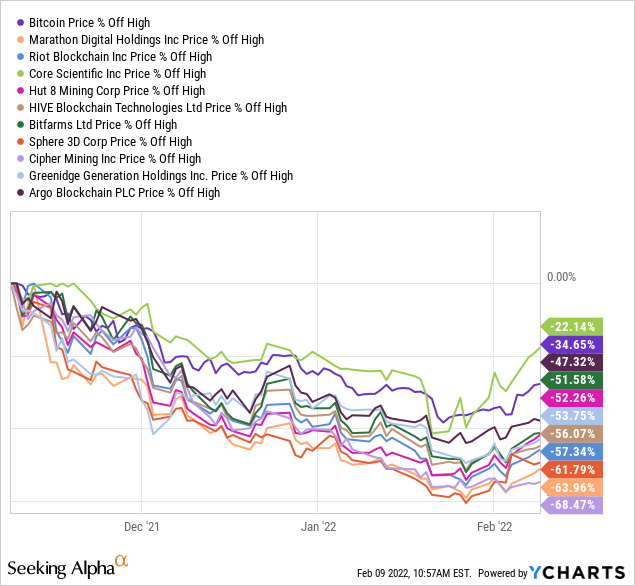

The other side to the concept known as operating leverage is the understanding that the value of the production is exposed to the risk of declining prices. Indeed, compared to the selloff in Bitcoin, mining stocks as a group underperformed with larger losses, many down by more than 50% over the period which also considers deflating valuation premiums.

Data by YCharts

What's important here is that for most of these companies it's been business as usual beyond the wild swings in their stock prices. Our takeaway from the chart above is that several miners are "cheap" at the current level with some room to narrow the spread vis-a-vis Bitcoin.

The theme for Bitcoin mining in 2022 is significant production growth with companies ramping up output from investments made over the past year. The result translates into higher levels of mined Bitcoins and revenue potential. The segment remains high growth with a positive outlook whether the price of Bitcoin is at $30k, $40k, or higher. We have confidence that Bitcoin mining stocks can end up outperforming Bitcoin to the upside as part of the bullish case.

The Top Bitcoin Miners

The opportunity for Bitcoin miners is significant considering 328,500 Bitcoins are expected to be minted from the network protocol over a full year representing a current market value of around $15 billion. BTC at $60k can push that value towards $20 billion. The miners with a larger network hash rate stand to capture an increasing share of the pie.

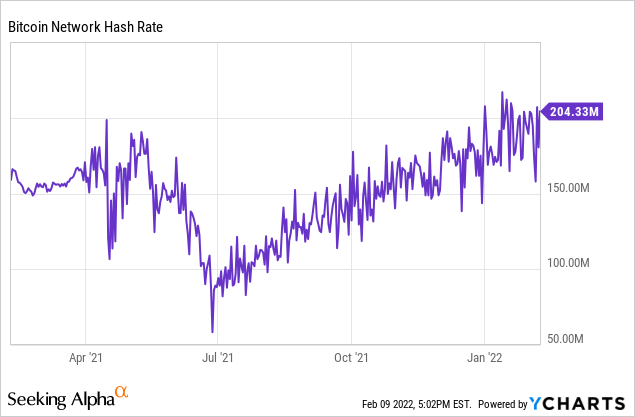

From the current network difficulty at 204 EH/s, a miner with 1 EH/s in capacity is expected to control 0.5% of the network translating to about 4.5 BTC in production from the network reward among ~900 BTC created each day. For a 1 EH/s miner, we can estimate an annualized Bitcoin production run rate of around 1,642 BTC representing about $72 million in revenue at a current market price of $44k. From there, we can take each miner's reported capacity and hash rate targets to forecast their production levels and implied potential revenue.

Data by YCharts

On the other hand, the miners adding hash rate capacity end up diluting the share for everyone else. For this reason, it's expected that the network difficulty will continue climbing over time. The understanding is that if the individual miners can increase capacity faster than the network or the price of Bitcoin continues to climb, the operation remains viable.

We're tracking around 20 names that we believe represent "pure-plays" on Bitcoin mining. From the list below, keep in mind that it's not meant to be all-inclusive. There is an even larger group of companies with a broader focus on "blockchain technologies" or related services including some companies that may also have smaller mining operations.

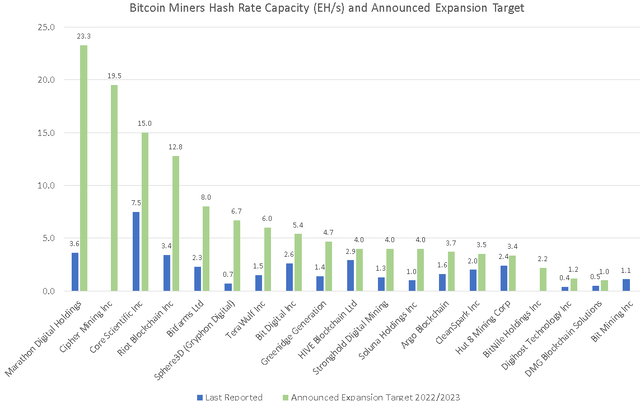

source: data from company press releases/ table by author

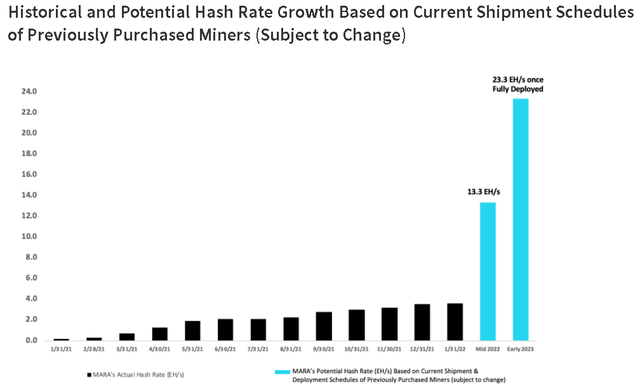

The largest current Bitcoin miner by market cap and production level is Core Scientific Inc (CORZ). The company just became publicly traded following a SPAC merger that just closed this past January. CORZ is reporting a self-mining hash rate capacity of 7.5 EH/s which is nearly double the level of the next biggest player with MARA at 3.6 EH/s. As mentioned, hash rate capacities for all companies are expected to ramp up this year. MARA is guiding for its hash rate to reach 23.3 EH/s by early 2023. Most companies are expected to grow capacity significantly over the next year.

source: data from company press releases/ chart by author

There are many moving parts and our caution here is to not make any assumptions based on a single metric like a miner's hash rate, production level, or BTC holdings. Cipher Mining Inc (CIFR), for example, is in the process of building out five data centers this year to ultimately reach 19.5 EH/s in hash rate. While the company expects an accelerated deployment of purchased equipment this year, the company has not yet begun mining operations which are reflected in the company's discounted valuation.

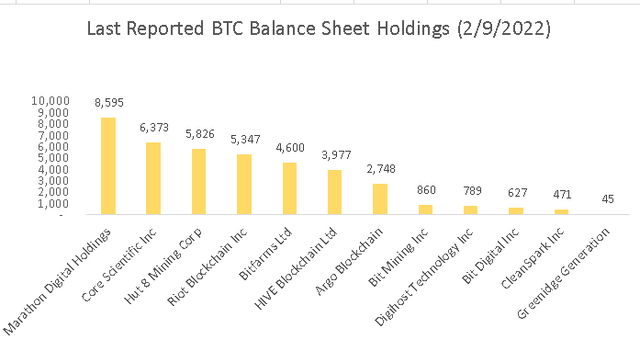

Another important metric for the group is each miner's balance sheet Bitcoin holdings. Here Marathon Digital has a lead with 8,595 BTC representing a market value of nearly $380 million. Part of that was acquired through open market purchases beyond mining. Some companies have made an effort to hold onto all BTC production while others realize the value to raise cash to support operations.

source: data from company press releases/ chart by author

There is some ambiguity here for miners that have focused on alternative cryptocurrencies like Ethereum (ETH-USD) including HIVE Blockchain and Hut 8 Mining. These companies are increasing their efforts towards Bitcoin while reporting an "equivalent hash rate" capacity and effective Bitcoin holdings based on the value of both cryptocurrencies. As it relates to Ethereum, there is a question mark regarding the long-term viability of the mining operation considering the launch of "consensus layer" as an update to the network that will ultimately make proof-of-work mining as a business model obsolete with a shift towards the alternative proof of stake which is less energy-intensive.

The understanding is that the full transition will take several years allowing HUT and HIVE among others to continue utilizing their extensive infrastructure for mining the Ether currency. Comments by management suggest they expect the operation to continue as-is for the foreseeable future. The companies may consider utilizing the equipment for alternative cryptocurrencies that are GPU-based mined like Monero (XMR-USD) or DogeCoin (DOGE-USD) for example. It's a topic that deserves a separate article but for our purposes just keep in mind that HIVE, HUT, as well as Bit Mining Ltd. (BTCM) have some unique aspects and are thus not directly comparable to the Bitcoin-only miners.

A big theme over the past year has been the emergence of several new Bitcoin mining companies that became publicly traded like Core Scientific, Cipher Mining Inc (CIFR), TeraWulf Inc (WULF), Stronghold Digital Mining Inc (SDIG), Greenidge Generation Holdings (GREE) and "Gryphon Mining" which is still in the process of completing a merger with Sphere 3D (ANY). Several other stocks have up-listed into NASDAQ including HUT, HIVE, Argo Blockchain plc (ARBK), Bitfarms Ltd (BITF), and Digihost Technology Inc (DGHI). The effort helps with corporate governance while enhancing the investment profile of the businesses.

Other aspects to consider include miners that own their underlying infrastructure in terms of data centers and power generating facilities as a form of vertical integration. There has also been an environmental push to utilize renewable power and clean energy.

The Best Bitcoin Mining Stock to Buy Now

When we look across the universe of crypto miners, it's clear that a rising tide of higher Bitcoin prices can "lift all boats". We are bullish on Bitcoin and expect the smaller players to rally in a scenario where Bitcoin breaks out. In this regard, some of the more speculative names may very well end up outperforming in percentage terms over any particular time frame. That said, in making a call on "the best" Bitcoin mining stock we are going for some balance recognizing that the space is already high-risk enough and focusing on quality. We want to be invested in a leading miner that can navigate different market conditions going forward.

In our view, the name of the game is the scale and the companies with the largest operations have several advantages between the ability to negotiate more favorable terms on future bulk purchases of mining equipment as well as capture higher levels of transaction fees within the network and mining pools. Separately, there is also some visibility to incorporate new revenue streams down the line like decentralized finance Bitcoin lending, considering what are increasingly large balance sheet holdings that provide financial flexibility.

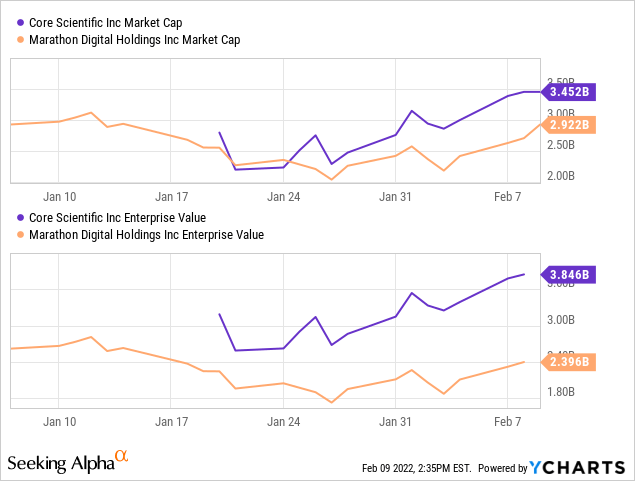

Our top pick for 2022 is Marathon Digital. In making our call, it's worth drawing a contrast with Core Scientific, which we also like, recognizing some of its strengths. That said, we make the case that MARA is undervalued between the two and has more upside. Compared to an enterprise value of $3.8 billion for CORZ, MARA is priced at a near 40% discount with an enterprise value of $2.4 billion.

Data by YCharts

We already mentioned that CORZ is the largest miner in terms of the current self-mining hash rash rate of 7.5 EH/s in January compared to 3.6 EH/s for MARA. Still, the key to recognize is that MARA is on track to overtake CORZ into the second half of this year with a roadmap to reach 13.3 EH/s by "mid-2022" and 23.3 EH/s by early 2023 while CORZ has only announced a target of 15 EH/s by year-end.

source: Marathon Digital

For simplicity purposes, assuming both MARA and CORZ are at 15 EH/s by the end of this year, that level of hash rate against an estimated network difficulty of 250 EH/s and market price of BTC at $44k implies about $867 million in annual self-mining revenue for both companies. With 23.3 EH/s hash rate fully deployed by 2023, MARA would approach annualized revenue run rate above $1.3 billion.

By this measure, it's clear that MARA is trading at a lower forward sales multiple. In terms of valuation, MARA has an advantage here because it maintains a net-cash balance sheet position while CORZ last reported $567 million in debt (S-1 filing, page 182) which adds to its enterprise value. From there, we conclude that MARA is relatively more attractive than CORZ and other major mining stocks at its current level through our estimated EV to potential revenue level multiple.

source: estimates by author

From the table above, we highlight that some of the smaller players look interesting with an even deeper discount, but we sense that MARA deserves a premium given its size compared to some of the micro caps. Nevertheless, names like BTBT, SDIG, SLNH, DGHI, and DMGGF deserve a closer look but are simply not our top pick. The table also omits some names that are less comparable including the Ethereum miners.

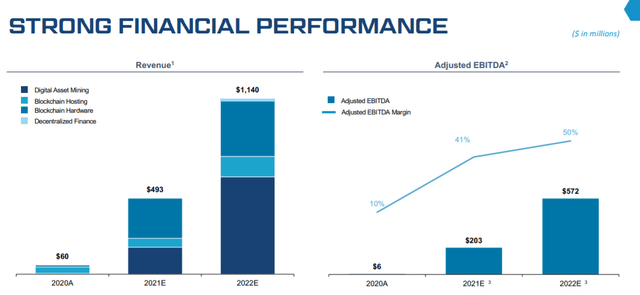

To be clear, it's never an apples-to-apples comparison. Core Scientific and Riot Blockchain for example run a strategy beyond Bitcoin Mining that also includes vertically integrated infrastructure with a separate blockchain hosting operation as a revenue source from its company-owned data centers. CORZ previously guided for 2022 total revenues to reach $1.1 billion and $572 billion in adjusted EBITDA with a reference price of BTC at $30k. It's fair to say that this side of the operation adds incremental value to the business and justifies some of the current valuation premium.

source: Core Scientific

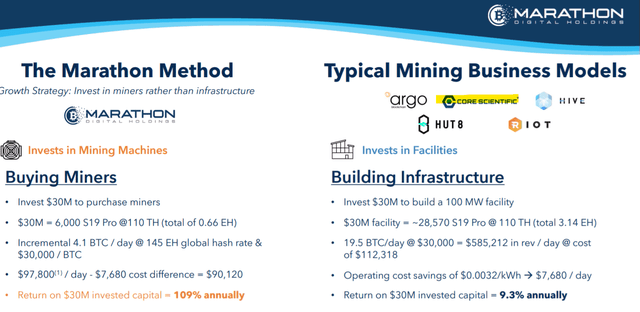

Marathon takes a different approach by choosing to focus all its efforts on buying mining rigs and expanding capacity. The company makes this distinction in contrast to other miners, including Core Scientific and others like RIOT, HUT, HIVE, and ARBK, which are building capital-intensive infrastructure. MARA instead chooses to outsource those services or through industry partnerships. The company believes its method can generate a higher return on invested capital with the added benefit of being able to expand more quickly and reach higher capacity over the long run.

source: Marathon Digital company IR

This is a case where MARA is "unhedged" to higher Bitcoin prices while other players are attempting to control all stages of production which adds a layer of complexity to the business. Our conclusion here is that MARA will be better positioned to generate higher returns in a bullish scenario where BTC climbs back to +$50k and beyond.

MARA Stock Price Forecast

It's worth noting that Marathon last reported its Q3 earnings back in November where it was able to post a positive adjusted EPS of $0.85 per share, excluding stock-based compensation. Revenue at $51.7 million increased 76% from the prior quarter in Q2 highlighting its growth momentum.

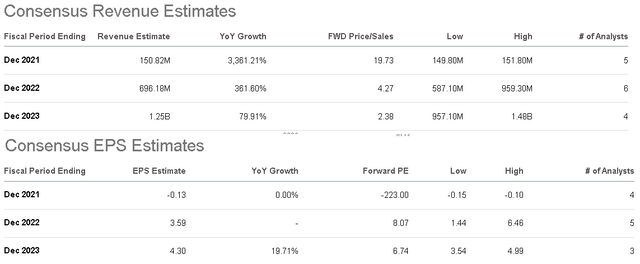

According to consensus estimates, MARA is on track to reach $151 million in revenue for 2021 including the yet-to-be-reported Q4 results. The trend ramps up to an estimated $696 million in revenue for 2022 which represents a 362% y/y increase. The key takeaway is that the company is expected to be profitable this year with a 2022 EPS forecast at $3.59 which implies a current forward P/E of 8x. This is achieved through a projected BTC production cost of $6,235 per BTC which includes electricity and hosting.

The market forecast for 2023 revenue at $1.3 billion will be driven by the announced capacity expansion. Earnings should benefit from higher margins achieved through scale. EPS forecast of $4.30 represents adjusted net income of around $430 million considering MARA's current 100 million outstanding share count, otherwise, an impressive earnings outlook that can climb into higher Bitcoin prices.

Seeking Alpha

With the next quarterly earnings report likely to be released in March, monitoring points include the trends in operating margins and cash flow. Management guidance in terms of financial targets will also be key to watch.

Any bullish case for MARA from here is going to need Bitcoin to sustain a trend of higher pricing over the long run. We've previously covered a bullish case for BTC highlighting secular tailwinds towards "digital assets" that can support higher Bitcoin prices. We believe those factors are still in place despite the recent volatility.

Looking at the price chart for MARA, the recent action shows that the stock has rallied from a low of around $20 per share several times over the last year coinciding with the times BTC tested a range between $35k to $30k as an important level of technical support. We make the case that MARA's outlook now is stronger than ever considering the expansion towards 23.3 EH/s hash rate was only announced back in December which improves its growth potential.

Seeking Alpha

We rate MARA as a buy with a price target for the stock at $50.00 per share which assumes a flat BTC pricing at the current level, implying a forward P/E of 14x on the stock against the current consensus 2022 EPS of $3.59. In our view, the company is fundamentally undervalued as an industry leader with overall solid fundamentals into accelerating earnings growth.

A continued rally in BTC from here should add momentum to the sector and we see MARA leading higher. A scenario where BTC reclaims its all-time high above $65k could allow MARA to retest its peak around $85 from 2021 representing nearly 200% upside. The asymmetric reward to risk ratio makes for a compelling buying opportunity in what remains a hot sector.

source: finviz.com

Risks

There are plenty of risks to consider. The reality is that cryptocurrencies remain one of the more speculative segments of the market and the mining companies are even higher risk with more volatility. Another leg lower in the price of Bitcoin under the $30k level, which we view as a critical level of support, can open the door for a deeper selloff in shares of MARA and force a reassessment of the long-term earnings outlook.

For MARA, there is some execution risk with the possibility that it fails to successfully deploy its mining operation on schedule or faces some setback related to logistics and infrastructure. Weaker than expected results over the next few quarters can further pressure the stock.

There have also been concerns raised about the environmental impacts of Bitcoin mining with some countries like China moving to ban the activity outright. While MARA with its U.S. operations avoids exposure to some of the higher risk international regions, efforts to add regulation can limit growth opportunities and pressure the market pricing of Bitcoin.

Bottom Line

Bitcoin mining stocks represent one of the most exciting sectors of the market. For many of the emerging leaders, 2022 is set to be a transformative year with surging growth that generates real cash flow and significant earnings. Marathon Digital Holdings is our top pick, but we are bullish on several names. Recognizing the uncertainties and high-risk nature of the group, we recommend investors only consider a small position within the context of a broader and more diversified portfolio.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Add some conviction to your trading! Exclusive stock ideas from our "ALPHA PICKS" along with the best daily market trading commentary. Join the community and active chat room. Click here for a two-week free trial at the Conviction Dossier.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!