More and more analysts published articles stating that the Fed's initial interest rate hike will not make the market go into a bear market.

Evercore ISI’s Ed Heyman and The Sevens Report’s Tom Esaiye used historical data analysis to show that when the Fed raised interest rates for the first time in a tightening cycle, the S&P 500 index still performed well.

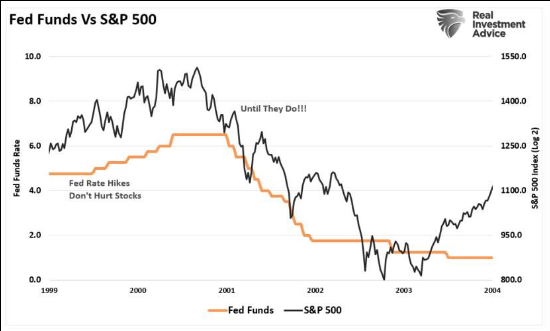

Overseas reporter Fred Inbert also wrote that in 1999 the Federal Reserve began its interest rate hike cycle and raised interest rates by 25 basis points to 5%. However, the S&P 500 has risen by 7% since then, and the cumulative increase for the year is 19.5%. .

This analysis does not violate the facts. When the Fed starts to raise interest rates, the stock market is often in a bull market with a strong trend. This is like a car going downhill in neutral gear. Raising interest rates is like braking. The braking effect may not be great at first, but when the time is long enough, the car will naturally stop slowly.

The risk facing US stocks is not the Fed’s first rate hike, nor the subsequent rate hike. Although generally rising interest rates will affect economic growth prospects, credit markets or the market’s bullish psychology, interest rate hikes will undoubtedly have a negative impact, but its negative impact has always been at a relatively low level.

However, it is undeniable that the stock market did rise by 7% after the Fed raised interest rates in 1999, but after the Fed ended its rate hike in 2000, the stock market fell nearly 50% in the next two years.

However, according to the analysis of economist Lance Roberts, the greater risk that U.S. stocks face is actually the abuse and misuse of U.S. stock buybacks. He said that although the company's share repurchase has been controversial, the market still does not know the extent of its impact on the financial market.

As we all know, low interest rates will hinder economic activity to a certain extent. In a low rate of return environment, corporate investment interest declines, and the use of stock repurchases can artificially increase corporate returns.

In the weak economic environment, one of the problems faced by enterprises is the lack of revenue growth. Given that higher stock prices can compensate corporate executives, companies tend to repurchase shares rather than obtain short-term gains through investment.

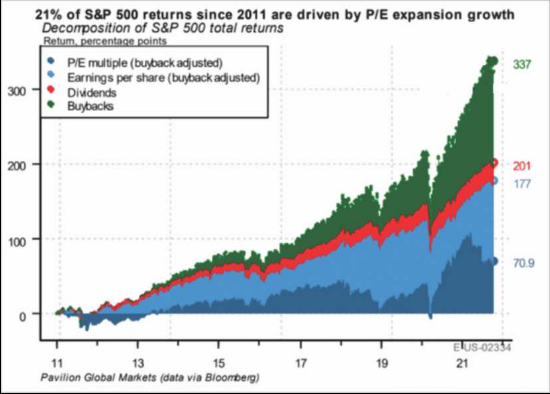

In the past decade, the surge in share repurchases has been one of the important supports of the financial market. This is because only the large market capitalization stocks in the market capitalization weighted index can afford billions of dollars in stock buybacks.

As can be seen from the figure below, in the return of the S&P 500 Index in the past 10 years, the P /E ratio has contributed 21%, earnings per share 31.4%, dividends 7.1%, and stock repurchases 40.5%.

So far, the reasons for the bullish US stock market include: low interest rates, low inflation, currency liquidity and zero interest rates, but Roberts believes that these seemingly reasonable factors are not all supporting the rise in stock prices. The real driving force behind the scenes is stock repurchase.

If there is no stock repurchase, the S&P 500 may not be pushed to the all-time high of 4700, but may be around 2800.

Bank of America said in its recent report that the weekly repurchase amount of its client companies rose to the highest level since March, reaching $3.4 billion, twice the amount of the previous week.

Stock repurchases are also an antidote to the Fed's withdrawal from monetary stimulus and to alleviate the panic of the new crown in the market. According to data collected by foreign media, since the beginning of January, US companies have planned to buy back 1.1 trillion US dollars of stock, which is almost three times the level of the same period last year.

Although the surge in share repurchases may temporarily alleviate market concerns about the end of loose monetary policy, this situation will not last long. Taking history as a lesson, the Fed’s tightening of monetary policy will slow down stock repurchases and reduce stock market returns.

As the Federal Reserve initiates a tightening monetary policy in 2022, the risk of a slowdown in stock repurchases will increase, especially the issuance of cheap bonds for stock repurchases.

2022 may be a turbulent year

Recently, the Federal Reserve has highlighted the outstanding risks that may damage the financial system, including the “structural weaknesses” of money market funds, the high valuation of the stock market, “stable coins”, and related issues caused by the popularity of cryptocurrencies, inflation, and fiscal spending cuts. risk. The Fed, as always, hopes to achieve a "soft landing" for US stocks. Unfortunately, their actions in this regard are always clumsy.

By 2022, the high-end U.S. stock market will face the following pressures:

As central banks slow down loose monetary policies, stock markets face the risk of overvaluation; global liquidity will decrease; higher inflation will curb consumption; economic growth will be weak; most economic data will grow weaker year-on-year; consumption The confidence of the investors is frustrated; the yield curve is expected to flatten; the company's profit growth begins to slow down; the profit margin is compressed.

Roberts said that since 2020, many favorable factors will become unfavorable factors. More importantly, when the company repurchases, they will find that they will face financial losses, more debt, and lose the motivation for continuous growth.

Perhaps, for investors who bet that U.S. stocks will continue to rise, the biggest risk is not the Fed’s interest rate hike, but the imminent decrease in the amount of stock buybacks.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!