A large basket of crypto stocks including Marathon Digital (NASDAQ:MARA), Hut 8 Mining (NASDAQ:HUT), Bitfarms (NASDAQ:BITF), MicroStrategy (NASDAQ:MSTR), slide into negative territory on Monday as bitcoin (BTC-USD) attempts to break out of mid-April levels, but quickly reverses lower to a trough of $61.7K before recovering back over $63K.

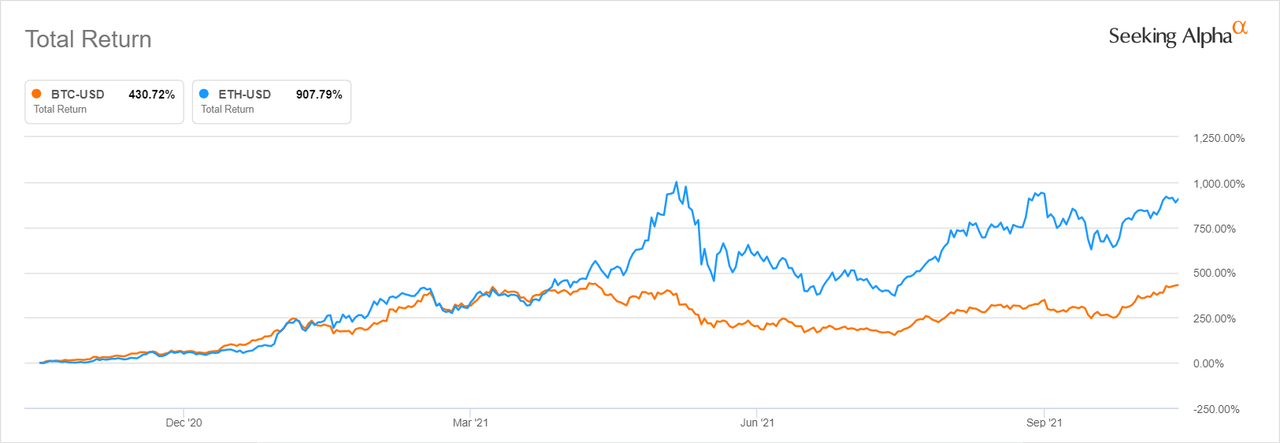

Bitcoin (BTC-USD) is slightly up on the day, up nearly 9% in the past five sessions, and +430% Y/Y, as per the chart below.

Perhaps the rapid rise and fall of bitcoin (BTC-USD) intra-day is likely attributed to the much-awaited ProShares Bitcoin Strategy ETF (NYSEARCA:BITO), which is highly correlated with the price of BTC, starting trading on the same day.

This is considered a big deal in the crypto community because it's the first bitcoin (BTC-USD) ETF that has been approved by the Securities and Exchange Commission to get listed as a publicly traded security; note that the fund doesn't directly invest in BTC, but holds futures contracts of the digital token.

For company specific news, crypto miner Riot Blockchain (NASDAQ:RIOT) develops 200 megawatts of immersion-cooling technology at its Whinstone facility, the first industrial-scale immersion-cooled deployment of bitcoin (BTC-USD) mining hardware, the company says.

"We anticipate observing an increase in the Company's hash rate and productivity through 2022, without having to rely solely on purchasing additional ASICs," said Riot CEO Jason Les.

Some other crypto-related stocks moving as bitcoin volatility rises includes: Net Savings Link (OTCPK:NSAV -1.0%), BIGG Digital Assets (OTCQX:BBKCF -1.6%), Cordia (OTCPK:CORG), KYN Capital (OTCPK:KYNC -4.7%), Vinco Ventures (BBIG -6.4%) and BCII Enterprises (OTCPK:BCII -16.4%).

Earlier, Grayscale Investment filed with SEC to convert popular GBTC into a Bitcoin spot ETF.

By: Max Gottlich

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!