Cryptocurrency exchange Coinbase is set to make significant changes in its offerings to Canadian users. In a move that highlights the evolving regulatory landscape in the country’s crypto market, the exchange has announced its decision to suspend the trading of certain stablecoins for its Canadian customers. This shift follows regulatory developments and reflects the exchange‘s commitment to maintaining compliance with emerging standards.

Trading Suspension for Select Stablecoins

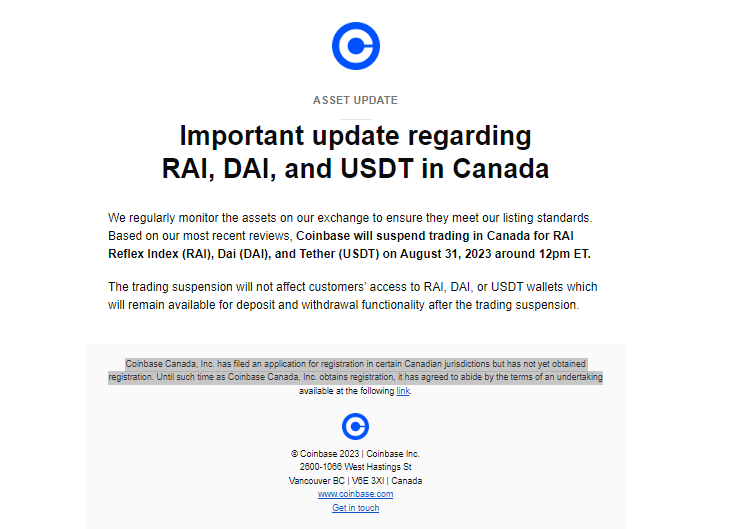

Communication to Canadian Users on August 17 (Source: Coinbase)

Coinbase‘s decision to suspend trading activities involving Tether (USDT), DAI, and RAI stablecoins for Canadian users has grabbed industry attention. Starting August 31, trading in these stablecoins will no longer be accessible to Canadian users. The exchange’s action follows an August 17 email communication to users, in which Coinbase emphasized its practice of continuous monitoring of listed assets to ensure adherence to listing standards. This thorough evaluation prompted the exchange to conclude that trading of the specified stablecoins will cease for Canadian users effective September.

Coinbase’s Operations Continue Amid Regulatory Transition

Source: The Block

While trading will be suspended, Canadian users of Coinbase will still retain the ability to execute deposits and withdrawals involving the mentioned stablecoins post the trading suspension. This pragmatic approach aligns with Coinbase Canada, Inc.’s ongoing pursuit of registration in select Canadian jurisdictions. The exchange has committed to adhering to an undertaking until its registration is successfully obtained. This arrangement allows users to manage their stablecoin holdings through deposits and withdrawals, maintaining a level of flexibility amidst evolving regulations.

It’s noteworthy that Coinbase’s move is not occurring in isolation. Earlier in the year, Crypto.com, a fellow digital asset exchange, delisted USDT for Canadian users. The regulatory environment has witnessed significant shifts, including the Ontario Securities Commission’s decision to ban USDT in 2021. This decision, though lacking a public rationale, marked a crucial regulatory precedent.

On February 22, the Canadian Securities Administrators (CSA) introduced new guidelines requiring registered or pending registration crypto exchanges to enter into legally binding undertakings with the regulatory body. Notably, these undertakings include provisions such as prior written consent from the CSA for clients looking to engage in activities related to Value-Referenced Crypto Assets, commonly known as stablecoins, through crypto contracts.

Conclusion

Coinbase’s decision to suspend trading of certain stablecoins for Canadian users underscores the industry’s efforts to navigate the evolving regulatory landscape. The alignment with new regulations showcases Coinbase’s commitment to compliance and responsible operations. This development, coupled with actions taken by other exchanges such as Crypto.com, OKX, and Binance, reflects the broader shift in the Canadian crypto space. As regulatory guidelines continue to shape the market, exchanges and users alike must remain adaptable to maintain the integrity of the digital asset ecosystem while upholding user experience and security.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!