If you’re looking for the best penny stocks to buy right now, there are hundreds of options to choose from. Now, understand where to look and which penny stocks are worth it, can undoubtedly be challenging. In 2022, it is all about considering what is affecting the market. This means knowing what events are occurring and how they may impact your portfolio.

To understand this further, we have to take a look at what is going on right now. The most pressing factors on the stock market include the pandemic, inflation, interest rates, and more recently, geopolitical tensions in Ukraine. All of these have led the stock market to be extremely volatile and reactive right now. While this may seem scary at first, it can be used as an advantage.

Because so many tend to swing trade penny stocks, large and predictable movement can be a major plus for profitability. But, it all comes down to knowing how to trade penny stocks and how to take advantage of the current situation. So, with all of this in mind, let’s take a look at three penny stocks to watch right now.

3 Penny Stocks to Watch Today

Sos Ltd. ( NYSE: SOS )

Transocean Ltd. ( NYSE: RIG )

Yamana Gold Inc. ( NYSE: AUY )

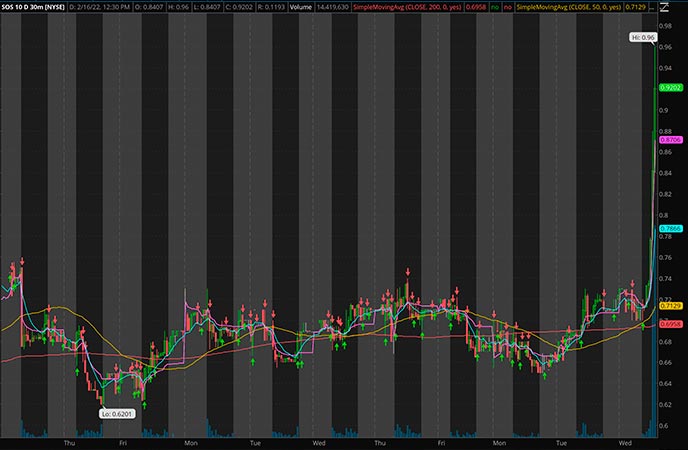

Sos Ltd. (NYSE: SOS)

One of the biggest gainers of the day so far is SOS stock. By midday, shares of SOS had shot up by over 26% to more than $0.90 per share. This is a sizable uptick and one that brings SOS’s five day climb to more than 30%. While there is no news causing this gain today, the company did make an announcement on February 11th. On the 11th, it stated that it received a letter from the NYSE notifying SOS that it was no longer meeting listing requirements. The NYSE requires that publicly listed companies maintain a listing over $1 for a consecutive 30-trading day period, and now, SOS has six months to do so.

If you’re not familiar, Sos Ltd. is a provider of a large range of tech and services. The majority of these are based in the blockchain industry where it offers big-data and marketing solutions. This includes blockchain-based tech, cloud computing, AI-solutions, emergency rescue and much more. Because of its broadness, the company has continued to see bullish sentiment from around the stock market.

And although it is tough to categorize SOS stock in one industry, it is to its benefit that it works in many. But, keep in mind that SOS is highly volatile as we’re seeing right now. And because of this, it is likely to move in both direction in large amounts and on a regular basis. So, with that in mind, will it be on your list of penny stocks to watch or not?

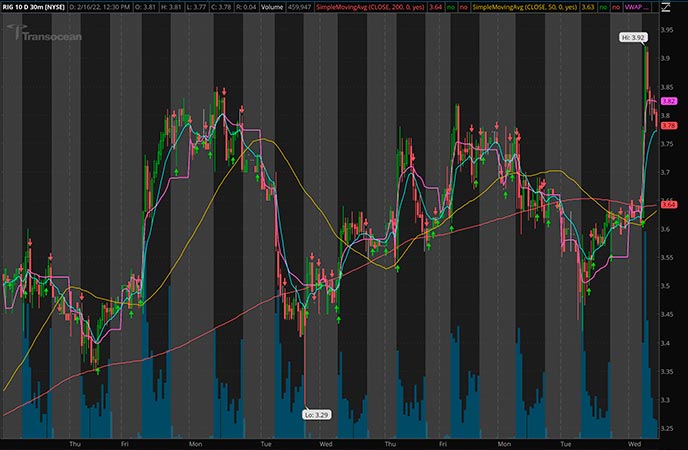

Transocean Ltd. (NYSE: RIG)

Another big gainer today is RIG stock. By midday, shares of RIG stock had shot up by around 3.7%. This brings its one month gain to over 7.8%. While this may not seem like a lot, it is quite substantial considering that energy stocks don’t tend to move this greatly.

[Read More] Are These 3 Penny Stocks on Your List in February?

However, right now, there is a sizable amount of movement in the energy industry due to larger geopolitical causes. The big news for Transocean in the past few days comes as the company announced it has won contracts for five of its offshore rigs.

Four of these will be headed to the U.S. Gulf of Mexico and one will be sent to the North Sea in the U.K. In its latest fleet status report, the company stated that this will bring in an aggregate incremental backlog of $87.7 million. This is all great news, especially considering the rising price that it can charge for its vessels to be deployed.

As of February 14th, the company’s total backlog is around $6.5 billion, which is no small feat. And, we’ve continued to see bullish sentiment in the energy industry in the past few weeks, especially as tensions rise overseas. So, while it is tough to say that RIG stock is worth buying right now, it could be worth adding to your penny stocks watchlist .

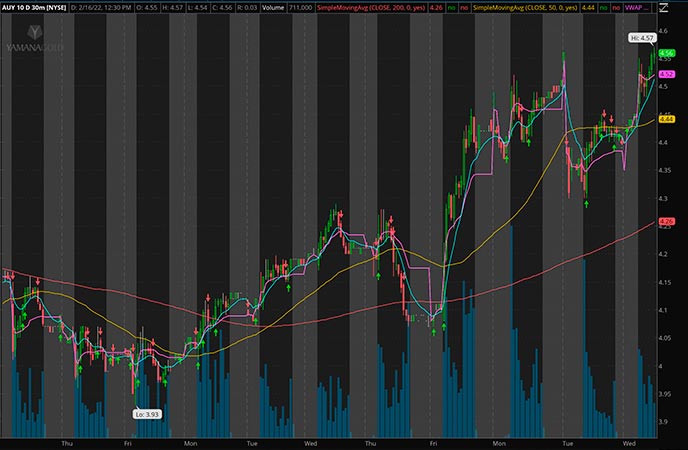

Yamana Gold Inc. (NYSE: AUY)

With a 3.1% gain today, shares of AUY stock are once again in focus for investors. In the past five days, AUY stock has climbed by over 8.7%, which is substantial for a mining stock. While it’s tough to say why AUY stock is increasing right now, we can look at a recent announcement from the company and the gold industry at large.

Last week, the company posted a report on its updated mineral reserves as well as its mineral resources. It stated that it has grown mineral reserves at the majority of its mines over the previous year. As of December 31st, the company reported 13.7 million ounces of gold mineral reserves. In addition, it posted 111 million ounces of silver reserves. All of this is positive news and reflects the growth of both Yamana and the gold industry at large.

In the past few weeks, we’ve witnessed sizable rises in the price of gold. Of course, this has been a major factor in the increasing price of AUY stock during that time. For those unfamiliar, Yamana is a provider of gold and silver with land positions in the Americas, Canada, Brazil, Chile, Argentina, and more. The company has continued to build upon these positions by growing its existing reserves and exploring new ones. With its recent momentum, do you think AUY stock is worth buying right now or not?

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!