Summary

Sphere 3D, an IT play with experience in GPU-based solutions is merging with Gryphon Digital Mining to create one of the leaders in Bitcoin production.

In addition, utilization of green energy as part of the ESG rationale makes a lot of sense with mining activities widely viewed as being power-hungry.

Sphere will also use its proprietary business solutions to optimize Gryphon's processes to provide more vertical integration synergies to the merger.

On a cautionary tone, the crypto market remains volatile stemming from regulatory threats.

Currently, at the $3.88 price level, Sphere is a buy because the way it is proceeding looks like it is setting the bar for the mining companies of the future.

If you just go by Sphere 3D's (NASDAQ:ANY) company profile, which is about "providing DATA management, desktop and application virtualization solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific", the Toronto-based company seems just like one of those IT companies offering hyper-converged infrastructure IT solutions. However, it is venturing into the highly profitable crypto mining space through merging with Gryphon Digital Mining, a privately-held company focused on mining bitcoin using renewable energy.

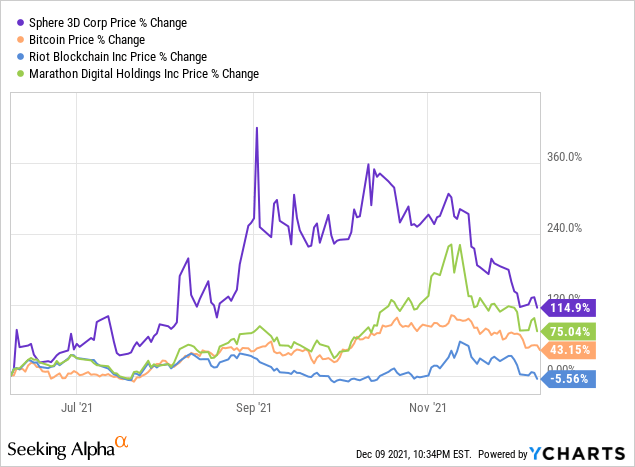

There is much more to Sphere's business model than just scaling Bitcoin mining, which is one of the reasons why its share price (in deep blue) has been less impacted than behemoths in the industry since it announced major developments around crypto at the end of May.

As you will discover in this thesis, I analyze this foray into digital asset production in light of key differentiators compared to the "conventional" crypto industry players, namely "using Sphere's proprietary business solutions to optimize" mining operations and making 100% use of renewable energy.

First, after so many promises, the market's adverse reaction to Sphere's third-quarter financial results, when the stock dipped by 11% according to SA, deserves analysis.

The results and crypto strategy

Q3's highlights were Sphere's successful pivot to the cryptocurrency mining industry with the purchase of the first cohort of 60,000 miners, capable of producing 5.7 Exahash of computing power. Out of these, the first batch of machines should have already been shipped during the third week of November. In addition, it secured a knowledge-sharing agreement with Gryphon Digital Mining, a privately-held company focused on the mining of bitcoin using renewable energy, and with whom Sphere is merging. The knowledge is about hosting about 230 megawatts of bitcoin mining capacity, covering over 71,000 bitcoin mining machines at the Core Scientific site.

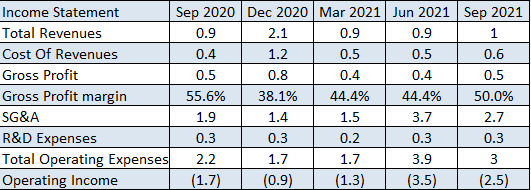

Looking at income, Q3's revenue was $1.0 million, compared to $0.9 million for Q3-2020 or an 11% increase. On the other hand, the gross margin was 46.6%, down from 60.0% for the third quarter of 2020, with operating expenses also rising by $0.8 million. Hence, net loss from operations increased to $2.6 million, up by $1.4 million from one year earlier.

Source: Seeking Alpha

These are the typical figures you would expect from an IT play focused on growth, but given the pivot to mining, it is the balance sheet that really matters. For this purpose, Sphere had $100.5 million of cash in the balance sheet as of September 30. Now, estimating that a miner costs around $6,700 based on the $48 million paid by Gryphon for 7,200 rigs from Bitmain (a mining equipment supplier), there is enough money to purchase 15,000 miners and achieve a leadership position in this highly competitive space which includes industry leaders Riot Blockchain (RIOT) and Marathon Digital (MARA), whose stock performance are in the introductory chart.

To this end, Peter Tassiopoulos, Sphere 3D's CEO said in August that "we are pleased to have the opportunity to place Sphere 3D as a leader in the space with state-of-the-art miners, in a very competitive market where time to delivery is paramount."

This is an ambitious target and to bring it closer to reality, Sphere sought the support of Hertford Advisors, a privately-held company that provides turnkey mining solutions for large-scale mining operations. I further elaborate on the details, including some key differentiators which the IT-turned-miner and its mining partner bring to the industry.

Aiming for the top with differentiating factors

I start with partner Gryphon.

Since August 2021, the miner receives batches of 600 machines on a monthly basis until the total purchase of 7,200 machines is up and running, with the order expected to contribute approximately 720 PH/s (0.72 EH/s) of hashing power. According to Cointelegraph, this would place Gryphon among the world's top 15 mining plays.

Another important point to consider is the ESG (Environment Social and Governance) dimension with the miner "using 100% hydroelectricity to mine Bitcoin" and additionally, the fact that it purchased "more than 250x more carbon credits" to offset the fossil fuel energy footprint that delivery of the mining machines would entail.

Second, as for Sphere, after its first 60,000 new Bitcoin mining machines deal with the manufacturer, deliveries are to be completed in September 2022, after commencing in November 2021 and lasting for ten months. On completion, it should have approximately 6 EH/s of computing power, where EH/s or Exahash per second is a measure of the total computational power used by the blockchain.

Now, this compares to 3.0 EH/s for Riot and 3.2 EH/s for Marathon of the end of November with both having expansion plans. For Riot, it is to reach 8.6 EH/s by 2022, and for Marathon, it is 13.3 EH/s by mid-2022. Consequently, with 6 Exahash, Sphere is not far behind.

Pursuing further, the agreement signed with Hertford also includes two additional contracts besides 60,000 miners. First, there is the purchase of up to 160,000 additional miners (totaling 220,000), and second, the right to complete negotiations to secure a "long-term contract for a 200,000 square foot crypto mining facility to be supplied with up to 1GW of carbon-neutral power". There is also provision for 1GW of power from the grid as backup, together with an agreement to offset all carbon emissions.

If all contracts are executed, Sphere will have 21.5 Exahash of computing power, a capacity sufficient to boost the company in the top ten mining pools, while confirming its CEO's aim to play a leadership role in mining. There is more with that partnership with Gryphon.

Vertically integrated synergies

In addition to the horizontal integration, whereby a company grows by acquiring or merging with another carrying out the same activities, the combined entity will also be vertically integrated. The reason is that Sphere will also leverage its GPU-based cryptocurrency mining solution "SnapMine" which will allow mining "not only BTC but also other coins outside of bitcoin".

For investors, Sphere launched SnapMine back in May based on its many years of experience in developing GPU-based converged systems. These are normally used for gaming purposes but their use has been "diverted" into cryptomining. This launch makes a lot of sense in a crypto market constantly looking for platforms that allow for easy customization, increased flexibility. Use cases encompass advanced home mining to commercial operations.

Additionally, the Antminer S19J Pro being delivered to Gryphon use an SHA-256 algorithm mining equipment which allows for mining of other coins besides bitcoin. This brings to the fore a diversification rationale.

Sphere also has years of data center experience, which is invaluable from the infrastructure viewpoint, especially considering that mining gear is in some way analogous to computing equipment in that both require power, cooling, and maintenance.

Pursuing on a cautionary tone, the company still has to reveal the details of how synergies will be obtained through vertical integration and there may be delays in shipping and installing the mining equipment due to supply chain issues. There may be other execution-related issues delaying attainment of the leadership position, but given the differentiators, the combined entity is on its way to setting the bar for the mining companies of the future and cannot be ignored.

Valuations and key takeaways

Coming back to the financing of mining activities, upon assignment of the contracts, the agreement is for Sphere to issue an aggregate of 4,500,000 common shares to Hertford. Based on a share price of $3.44 on August 5, at the time of signing the agreement, I obtain a value of $15.5 million.

Furthermore, on September 2, the company offered 22,600,000 common shares and warrants to purchase up to 11,300,000 common shares directly to institutional investors. The exercise price of each warrant will equal $9.50 per share valuing the financing transaction at $107.4 million (11,300,000 x 9.5). At that time, the company's stock jumped to $9.4.

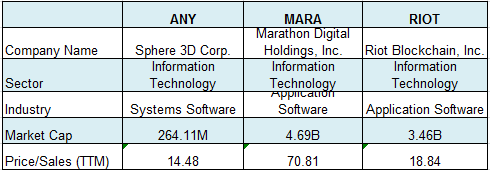

The stock has retreated since and is now under the $4 level, with the trailing Price to Sales multiples of 14.48x signifying undervaluation with respect to Mara and RIOT. Adjusting accordingly, I obtain a target of approximately $5 (18.84/14.48 x 3.88) for Sphere based on its current share price, which is still at a considerable discount to the $9.4 high.

Source: Seeking Alpha

Current volatility should persist due to crypto being the focus of the House Financial Services Committee as I explained in my recent thesis about Hive. Having in mind genuine concerns concerning investor protection and market integrity, regulators are likely to enforce some form of "centralized regulatory framework" for digital assets bearing in mind that the industry is vulnerable to manipulation, fraud as well as hacking.

However, far from implementing some abrupt moves, regulators are more likely to proceed step-wise, taking into consideration that some industries built around the crypto ecosystem, namely DeFi and NFT are now worth $80 billion and $7 billion respectively. It is precisely here, that Sphere's ESG rationale involving the green agenda right at project start being different from conventional miners who have only recently begun to add renewables to their energy mix.

by Chetan Woodun

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!