Summary

Located in the top tier NASDAQ Global Select Market, the Canadian miner has been able to rapidly raise money for growth.

Amid all this spending for growth, and in a competitive environment with miners focused on producing Bitcoins, it becomes important to look for supply chain bottlenecks and profitability metrics.

Also, cryptomining being a power-hungry activity, particular attention has to be given to Environmental Social and Governance (ESG) factors, with climate change activists being increasingly vocal against Bitcoin's fame.

Hut 8 exhibits some good metrics, but it will not be sparred by volatility so inherent of Bitcoin assets.

After a vertiginous rise, valuations are high but need to be assessed with respect to peers, while not forgetting the Bitcoin hodled.

With talks that Bitcoin is now being used as a hedge against inflation, I focus my attention on miners or those companies which produce cryptocurrencies. In this thesis, I cover Hut 8 Mining (NASDAQ:HUT), which is among the largest in North America. Its share price has appreciated by 150K% over the last year and after such a whopping gain, the question is whether the stock can move higher.

Moreover, the CEOs of mining plays like to gossip a lot about their hash rates, or the speeds at which their cryptomines operate, and while most people's eyes are glued to the number of Bitcoins produced and the associated value in dollars, I also focus on the operational expenses.

Revenue growth and value of mining assets

As per the earnings call on August 12, total revenue for Q2-2021 was $33.5 million compared with $9.2 million in the prior-year quarter, or more than 285% growth. The bulk of revenues was constituted of mining activities, at $31.4 million.

Going into details, second-quarter revenues were made up of 553 new Bitcoins mined at an average of approximately $56,700 per coin, whereas one year ago, Bitcoin was priced at around $15-16K. This surge in price as well as an increase in hash rate, which is up by 65% year-over-year explains the 285% performance.

Thus, Hut 8 reported 264 Bitcoins mined in September, signifying an average production rate of 9.11 Bitcoin/day during the month, with the company's total Bitcoin balance held in reserve as of September 30 standing at 4,724 with a fair market value of $283.4 million (based on Bitcoin at $60K each).

This compares with 340.6 new-minted Bitcoins for Marathon Digital Holdings (NASDAQ:MARA) in September, increasing total Bitcoin holdings to approximately 7,035. Its average production rate of 11.35 Bitcoin/day was also higher. This amounts to a fair market value of approximately $422 million, again taking a unit Bitcoin price of $60K.

Riot Blockchain (NASDAQ:RIOT) produced even the highest number of coins, at 406 BTC, or an increase of approximately 346% over its September 2020 production of 91 BTC. This was made possible through a faster rate of 13.53 Bitcoin/day (406/30). As of September 30, 2021, Riot held approximately 3,534 BTC, all of which were produced by its self-mining operations. This amounts to a fair market value of $212 million.

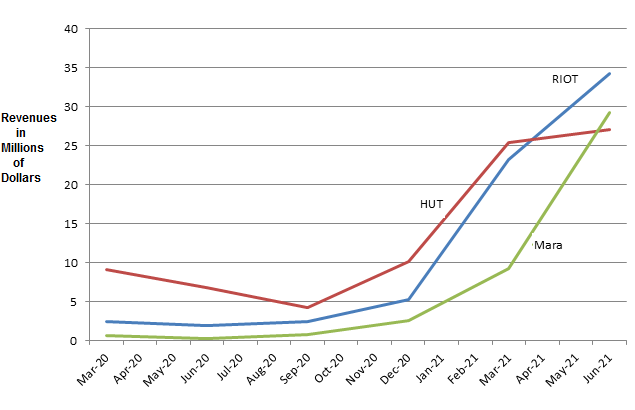

A graphical representation over the last six quarters clearly shows the superior growth path of RIOT from the beginning of this year. Marathon has also grown revenues, but at a somewhat slower pace whereas for Hut 8, growth has been sluggish.

Source: Chart built using data from Seeking Alpha

This moderation in Hut 8's growth is explained by a delay in setting up servers powered by NVIDIA (NASDAQ:NVDA) cryptocurrency mining GPU processors. These were received on time, but assembly (putting cards and processors into the servers) and powering up took some time due to the power infrastructure required to support the equipment not being available in July and having to be postponed to August and September.

Assessing H2-2021 production capacity, with 9.11 Bitcoin per day produced as of the end of September, the company is capable of producing around 838.12 Bitcoins in three months, and with 4724 already in the inventory as of September 2021, Hut 8 should be ahead of its schedule to have 5K+ self-mined Bitcoin by end of Q4.

High growth levels are key to satisfy the demands of a Bitcoin-thirsty market. In this respect, a study by Goldman Sachs conducted among 150 Family Offices around the world showed their growing interest in blockchain investments, with 15% of survey respondents confirming having already invested in cryptocurrency, and 45% intending to do the same for protection against "higher inflation, prolonged low rates, and other macroeconomic developments".

Operating expenses and ESG

Now, spending for growth in a highly competitive environment calls for prudent financial management, one where the cost element is also taken into consideration. For a miner, the two most important cost items are mining equipment and electricity consumption.

For Hut 8, the cost of revenues and operating expenses amounted to $16.8 million in the second quarter compared to $15.5 million in the prior-year quarter, mostly due to electricity and site expansion costs. However, excluding equipment depreciation expenses, the cost of mining each Bitcoin for Q2 has actually been reduced to $24,900 compared with $27,000 in Q1 of this year. These figures comprise electricity, fees, as well as personnel, network monitoring, equipment repair, and maintenance costs.

Consequently, Hut 8 is profit-making and its operating margins have progressed more smoothly over the last six quarters, in contrast to the more erratic movements shown by RIOT and Marathon.

Going into details, after some exceptionally high administrative costs pertaining to the new organizational structure, G&A costs should normalize over the balance of 2021 though continued short-term volatility is expected as the company continues to experience significant growth.

The company has also invested in a power purchase agreement, building out a third facility in Alberta with the executives talking about "incredibly compelling power rates". Additionally, Alberta with 20% of renewables right now in its grid is focused on aggressively greening up its energy sources between now and 2030, through investments in wind and solar farms around the province.

Then, there are the NVIDIA chips, synonymous with more power-efficient mining coming on board as part of diversification into Ethereum. For investors, according to some sources, Bitcoin requires 707 kWh of electricity per transaction, while for Ethereum, it comes only at 62.56 kWh, constituting a much smaller energy footprint (usage).

For this matter, mining activities, just like data centers require a lot of energy, and exhibiting lower expenses is sure a plus point considering that ESG-conscious investors filter out mining plays to select only those that use a higher percentage of renewables in their energy mix.

In addition, the executives have launched several ESG-related initiatives around energy efficiency and recycling.

Valuations and key takeaways

With its high ESG aspirations in a world increasingly looking at ways to combat the problem of climatic change, Hut 8, as the first Canadian digital asset miner to successfully list up in the NASDAQ, more specifically in the top tier NASDAQ Global Select Market should continue to garner attention.

After recent upsides, it comes at 19.27x price to sales (trailing), but this is with respect to the broad IT sector. Being more granular, the stock remains undervalued relative to U.S. peers. Also, miners as producers and hodlers (storing Bitcoins they have produced instead of selling them) have traditionally enjoyed better valuations than Bitcoin itself. For this purpose, I consider the NYSE Bitcoin Index, which I use as a baseline.

Viewed from this angle, Hut 8 remains undervalued by 367% (792.4-425.4) with respect to the Bitcoin index and adjusting accordingly, I obtain an estimated stock price of above $44.

To be realistic, this is a very high target and will depend on the ability of the company to execute its growth mandate, while overcoming supply chain bottlenecks in the future. Hut 8 certainly has the capacity to grow, namely for the acquisition of new mining equipment and setting up of new facilities, after raising $115 million of capital in June 2021, supplementing the $77.5 million raised in January.

In addition, to leverage Bitcoin holdings and generate additional free cash flow, the company has lending agreements enabling it to earn $1.3 million in the first half of 2021.

Going forward, the upcoming COP26 summit in Glasgow, Scotland, at the end of October, should be a highly volatile event for Bitcoin assets, as surging demand and adoption of blockchain amongst businesses is highlighting the adverse impact of the technology's growing energy consumption on the climate.

There is also regulation-related stock volatility risk, but I believe that this is just one hurdle to be overcome after the Internal Revenue Service defined Bitcoin as property subject to capital gains tax and obtaining the trust of large institutions as from the beginning of this year. Thinking aloud, while regulatory measures will surely add to operating expenses across the cryptocurrency value chain, more oversight on entities helping to process Bitcoin transactions by the U.S. Treasury's Financial Crimes Enforcement Network should have an overall positive effect on recognition of Bitcoin in the financial system.

Finally, as a hodler, the company should possess at least 5,562 (4,724+838) Bitcoins by the end of this year, and even selling these at 50K each should fetch a whopping $278 million, or more than eight times 2020 revenues of $32 million. At the same time, Hut 8 is rapidly expanding its hosting business to constitute another revenue stream alongside self-mining activities.

Disclaimer : The above empty space does not represent the position of this platform. If the content of the article is not logical or has irregularities, please submit feedback and we will delete or correct it, thank you!